Lecture – Positioning and Trends

Like many aspects of the marketing world, positioning can be a challenge. You aren’t going to just ‘know’ how to position a product, it’s simply not that easy. Being one of many businesses in a crowded market can leave you struggling to figure out how you differ, and how you can stand out.

Positioning is essentially giving context to your products and services. Context helps people to make sense of the world around them— particularly new things or things we’re experiencing for the first time. Brand positioning may seem like a simple context to grasp, but there are many factors that go into how a product or service is positioned within a market and in the minds of your buyers.

When markets are crowded, your brand positioning strategy is of high importance. If the markets are this crowded, you want to be positioning yourself differently than the competition, and make it known. If you can’t explain exactly what your product/service is meant for, and how you are unique against the substitutes, then customers aren’t going to be receptive.

Weak brand positioning will feel like you’re running uphill, no matter how great your marketing is. But a strong position feels like you’re lucky— it’s magic.

To set the context of a product, you must do two things:

1. Position deliberately

2. Follow a process

The value that you bring all depends on who your customer segment is, your key unique attributes all depend on who your competitors are, etc. Each part of the process relates to the others—they are not mutually exclusive components.

Regardless of the current trends, your market category should always stay the same. Trends can be a great way to stand out and get noticed by customers, while still being clear about the category and context of your product. Market categories are the competing brands within a specific market arena.

Trends are changes or developments to something new or different. Trends are typically temporary until a new trend comes along. For example, each year Pantone releases a specific “color of the year”, which ends up being the color trend for the year. Living Coral was the decided 2019 color trend.

Trends are a great opportunity for marketers to capitalize on, but you must know how to incorporate them properly with your solutions and market category. If you are focused too much on the current trend, there is a chance you’ll confuse your potential customers. Trends can’t redefine a market, but they can make it more interesting. The best thing that you can do is find the intersection between your solution, market context, and trend. You’re trying to find the perfect blend of all three to be the most successful in your product positioning.

Workshop Challenge

Emerging Trends & Innovations – Electric Vehicles

According to Technia.com, there are six trends that are shaping the EV industry today:

1. Advanced Creative Design

Today’s EV buyers are demanding. They don’t just expect innovative technology under the hood, they also expect beautiful design, smart use of space (including for batteries and fuel cells), plenty of choice and, of course, excellent safety standards.

2. Intelligent Vehicles

Autonomous, self-driving vehicles have caught the interest of fleet and private consumers alike. Take companies like Einride, the Swedish company behind the T-pod and T-log, which has developed a system whereby an operator can remotely control multiple self-driving trucks at once, cutting out the need for a large, dedicated team of full-time operators and drivers. This level of efficiency is reinventing whole markets.

3. Increased Range

A major challenge for EVs is their limited range compared to ICE – Internal Combustion Engines. Overall operating costs are often lower, but when you factor in the availability of refueling options, speed and convenience, ICE still has the advantage. EVs take much longer to recharge and run out of power faster. Developers are experimenting with several possible solutions, including interim options like range-extending hybrids, and intriguing long-term alternatives such as the solar-powered car.

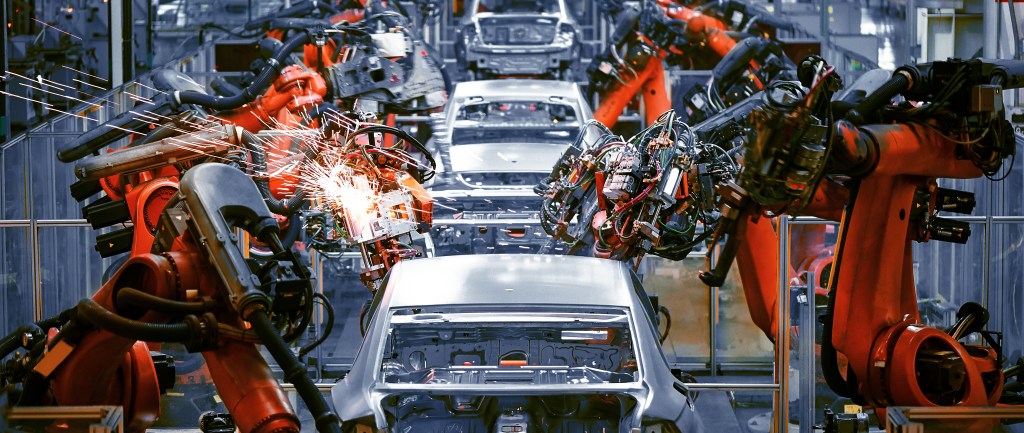

4. Growing EV Production

EVs are potentially cheaper to run and maintain than traditional cars. Unsurprisingly, that’s making them an easier sell for consumers – and in turn, that’s increasing demand for more EVs in a broader range of models.

5. Electrify ICE

So popular are EVs that even established ICE giants are now moving towards converting their ICE-powered vehicles to hybrid or fully electric. To take advantage of this trend, EV design teams are looking beyond EV-only products.

6. Using PLM to Speed Up EV Innovation

What do Tesla, BMW and Faraday Future have in common? Yes, they’re all leaders in the EV space, but importantly, they’ve also achieved this with the help of powerful, world-leading PLM technology. This allows them to track precisely, and collaborate on, all stages of product development. From idea conceptualization and consumer/market buy-in through to customer delivery. They can also make changes to the design in a few clicks and simulate the results immediately, making it faster and easier to experiment with new ideas and stay ahead of the curve. With ICE-powered vehicles facing phase-outs around the world, and incentives springing up to encourage EV designers, there’s never been a better time to innovate in the industry.

(Source: https://www.technia.com/blog/top-trends-in-electric-vehicle-design-and-how-to-implement-them/)

According to Solar Impulse, there are three EV challenges:

1. Holistic approach

A holistic view is needed across the entire EV value chain. This ranges from ensuring supply meets demand, to having energy infrastructure in place to deliver the power needed, operation and maintenance, and setting up a second-hand market as the EV markets advance further. One of the current barriers to deployment is availability of vehicles, which opens a huge opportunity for automotive suppliers. Coordination of the siloed EV supply chain is vital to making the entire experience for consumers as seamless and convenient as possible.

2. Charging Infrastructure

One of the key points discussed during the panel session at the CVEI project (Consumers Vehicles & Energy Integration) event was instilling consumer confidence in EVs – supported by a national network of reliable and accessible public charging points, particularly along motorways and A-roads. This requires a coordinated effort at an individual council and network operator level to ensure that the extra low emission power needs can be met without straining the local network. Using solar and storage is key to alleviating additional demand on the grid and delivering flexibility and sustainability. The acceleration towards sustainable transportation can be driven by commercial fleets and public bodies, who have the economies of scale to make the transition financially viable.

3. Collaboration

EV transportation is multi-layered and incredibly complex, requiring strong partnership between the energy and transport/logistics industries and involving several other technology providers and stakeholders, such as operations and maintenance providers; software specialists; charge point operators; mobility service providers; businesses and public bodies; individual consumers and local and national governments.

This approach is working in the Netherlands, where public private partnerships helped create the market model that spurred the EV industry growth and made it the success story it is today.

(Source: https://solarimpulse.com/news/preparing-for-the-electric-vehicle-revolution-three-emerging-trends#)

The spirit of innovation and collaboration in the EV mobility sector points to an exciting future to reshape the future of energy and transport sustainability. As we strive to decarbonise the global economy and reduce air pollution across our towns and cities, the EV sector offers an affordable long-term solution that can work in harmony with a wider lower-carbon energy system.

According to Geo Tab’s white paper: Electric vehicle trends 2020: Top 6 factors impacting fleet electrification, there has been an increasing movement towards sustainable fleet management over the past five years, especially for many organizations with large fleets. Electrification has been a fundamental element of this transition. Integrating electric or hybrid electric vehicles into the fleet portfolio helps address sustainability and environmental goals.

1. The EV price tag will continue to drop as battery costs fall

The cost drop on lithium-ion batteries since 2010 has been substantial and continues to do so. This will help to bring forward the moment when there is upfront price parity between electric and internal combustion engine (ICE) vehicles, which they now predict to be around 2022. A combination of factors is driving these substantial cost reductions.

Improvements in battery technology

Manufacturers have made substantial advances in the chemistry of their batteries. One such advance is a move away from cathode chemistries that are dependent on cobalt, toward nickel-based systems. Nickel-based cathodes benefit from a higher energy density, longer life cycle, and a lower cost than cobalt-based cells.

Industrial policies supporting battery development

Many governments have recognized the strategic importance of supporting battery manufacturing for the EV sector, since this technology will be vital on a large-scale to help them transition their domestic energy supplies to renewables.

The U.S. Department of Energy’s Vehicle Technologies Office (VTO) collaborates with national laboratories and industry to improve batteries and electric drive systems.

The European Commission’s Strategic Action Plan for Batteries seeks to build a robust battery value chain within Europe. The primary objective of this initiative is to attract more investment and to position the EU as a larger player in the battery industry, in competition with the U.S. and China.

Increasing production capacity

The scale of battery manufacturing plants is gradually increasing and transitioning towards mega plants, significantly reducing the cost per unit.

2. Electrification will spread into the heavier vehicle segments

As of 2019, most of the electric vehicle fleet was comprised of light-duty cars and two-wheelers. Thanks to advancements in battery chemistry, tightening emissions regulations, and more models coming online, it is expected that electrification will extend into heavier applications.

Commercial electric vans

For organizations running vans in city centers, the case for transitioning to electric from diesel is compelling, with strict air-quality standards making it increasingly unviable for many operators to run their diesel vehicles. Electrification can now be considered a genuine alternative due to the falling upfront costs of electric vans, improved battery capacity and range. Traditional van manufacturers have started to recognize the increase in demand and are now launching electric models.

Electric buses

In the right applications, such as in urban transit and school districts, bus electrification is proving to be a viable opportunity. BloombergNEF estimates that by 2040, electric buses will represent just under 70% of the global bus fleet. China currently accounts for 99% of global market share, but that will gradually fall through the 2020s as the rest of the world catches up.

The three main suppliers of electric buses in the U.S. are New Flyer, Proterra, and BYD. Daimler is funding Proterra to develop electric school buses, while New Flyer and BYD are planning to invest in manufacturing electric buses within the country.

New York City and California have both set goals to transition to 100% zero-emission bus fleets by 2040. Mandates to promote the electrification of public transportation are starting to influence the procurement process, with transit licenses often granted through competitive tenders.

Medium and heavy-duty trucks

The market for medium and heavy-duty EV commercial vehicles is currently small compared to other vehicle types. Several major truck OEMs have come out with ambitious plans to launch electric product lines, and some models are now commercially available. There are also a handful of pure-electric manufacturers that are planning to enter this market, including Tesla and Thor Trucks.

Early adopters of electric trucks have predominantly urban and port duty cycles, since this allows for charging along the routes and puts less of a requirement on battery capacity. Electric trucks may even benefit from preferential access rights in some cities, due to the lower air and noise pollution created by the vehicles compared to diesel. The proliferation of low- or zero-emission zones expected to come into effect in this next decade suggests that electric trucks are likely to make a strong penetration into the marketplace, particularly in cities.

3. Updates to policy and regulation

Many of the countries that are leading the transition to electric are gradually shifting their policies from direct purchase incentives for EVs, towards zero-emissions vehicle (ZEV) mandates and/or regulatory requirements related to fuel economy, and pollutant and GHG emissions.

Zero-emission vehicle deployment

California is the state with the most aggressive deployment targets, with a goal to have 5 million EVs on the road by 2030. Other states have adopted goals for ZEV deployment and provided rebates for ZEVs and incentives for ZEV infrastructure, such as EV supply equipment (EVSE) infrastructure. Colorado has announced plans to join the California ZEV program from 2023, and three other states are following California’s LEV standards, rather than adopting the ZEV program.

Two Canadian provinces also have aggressive targets with British Columbia requiring 100% of all cars sold to be electric by 2040 and Quebec who currently leads ZEV adoption across Canada with similar goals to California.

Fuel economy and emissions standards

All major markets have fuel economy and emissions regulations in place. To meet these mandated targets, the EV market will have to grow significantly.

City access restrictions

Worldwide, twenty major cities have announced plans to ban gasoline and diesel cars by 2030 or sooner. In Europe, Paris has set targets to ban all gasoline and diesel vehicles from the city center by 2030, and Copenhagen plans a staggered ban on diesel cars, starting in 2022. Central London will implement zero emission zones by 2025, and already operates an Ultra-Low Emission Zone (ULEZ), which charges a daily fee for diesel vehicles manufactured pre-2016 and petrol vehicles manufactured pre-2006. In Asia, Beijing has weighted the balance of its number plate lottery in favor of EVs, with over 60% of number plates allocated to new EVs in 2019.

4. Increase in public charger availability and capacity

As of May 2019, there are now over 20,000 public EV charging stations with more than 68,800 connectors across the U.S. Of that total, approximately 16% are DC fast chargers. Many players are active in building out this infrastructure, including utilities, oil and gas companies, and automakers. However, it is generally understood that the scale of infrastructure needs to grow exponentially in order to serve the growing fleet of EVs and to meet policy targets. Most fleets will not rely on public charging though and may be able to obtain all their charging from private infrastructure, such as at their own fleet facilities.

Ultra-fast chargers, wireless charging and battery swapping are all emerging as solutions to improve the public charging experience. These charging innovations will make EVs fully competitive with their ICE counterparts regarding the fueling experience for drivers, who don’t have home or workplace charging. This is a key concern for policymakers and automakers alike in order to substantially incentivize the transition to electric.

The dawn of the mega-charger in heavy duty

Several companies have stated their intentions to develop mega-chargers that could charge at 1 megawatt (MW) or above. With the growth in demand for electric intercity buses, as well as medium- and heavy-duty freight trucks, all of which have limited time windows for charging, interest in this technology is expected to explode.

Tesla is developing this infrastructure to support its semi heavy-duty truck, with estimated recharging capacity as high as 1.6MW. ChargePoint has already presented a four-set interface concept that would provide a combined power of 2 MW, suitable for heavy trucks and electric aircraft.

Investments in public charging infrastructure

China currently has the greatest number of charging points in the world, followed by the U.S., Netherlands, Japan and Germany. At the other end of the spectrum, Australia, Poland and Hungary have the lowest number of charging points per 100 km.

The U.S. is working to further build public charging infrastructure in the country. More than half of U.S. states now have EVSE incentives in place. California is making the greatest investment in infrastructure deployment, with targets to deploy 250,000 charging points by 2025. An estimated 4% of outlets are expected to be DC fast chargers. Various other states are increasing their financial commitments for charging infrastructure, in partnership with electric utilities firms.

In Europe, the Alternative Fuels Infrastructure Directive requires member countries to set deployment targets for public charging infrastructure in 2020 as part of their national policy frameworks. Based on current levels of deployment, the IEA predicts that the target of one public charger per 10 electric cars is likely to be achieved by 2020.

5. Collaboration accelerates EV adoption

More and more cities, local governments and utility companies are developing programs for vehicles and infrastructure upgrades, bringing about greater opportunities for collaboration and shared learning. Organizations such as the Electric Power Research Institute (EPRI) and the U.S. Department of Energy (DOE) offer thought leadership, industry expertise, and policy updates to their stakeholders.

For smaller fleets that may not have the internal capacity or EV knowledge in-house, collaboratives offer a chance to learn from peers and take advantage of external expertise in electrification. Collaboratives could also open the possibility of group purchasing opportunities that can lower the costs of EVs for all involved.

Public and private sectors show their intent

In 2019, the U.S. Climate Mayors launched their Climate Mayors Electric Vehicle Purchasing Collaborative to leverage their collective buying power and accelerate the conversion of public fleets to EVs. They have committed to purchasing more than 2,100 EVs by the end of 2020, with the intention to send a signal to the global auto market and help the U.S. maintain its commitment to the Paris Climate Agreement. The collaborative offers an online procurement portal that provides U.S. cities, counties, state governments and public universities equal access to EVs and charging infrastructure, financing options and best practice guidance.

The European Association for Electromobility (AVERE) promotes electric and sustainable transport throughout Europe, supporting the work of policymakers to establish effective policy frameworks throughout the EU. Members range from SMEs to vehicle manufacturers and other companies with a commercial interest in electromobility. AVERE provides its members with a forum for exchanging knowledge, experience, and ideas on how to stimulate electromobility throughout Europe.

6. EVs to dominate shared mobility services

Shared mobility, including services such as car sharing, taxis and ride hailing, currently accounts for an estimated 5% of the total annual distance travelled by passenger vehicles. However, the growth in popularity of these services is expected to rise exponentially in 2020 and beyond.

With higher utilization rates than for private ownership, the economics of EV usage for shared mobility are considerably more favorable. Total cost of ownership is lower for shared mobility vehicles due to the lower ‘fuel cost’ of electricity compared to diesel, and lower maintenance costs related to the comparative simplicity of the electric drivetrain. These factors can combine to make EVs cheaper overall. EVs currently account for 1.8% of the shared mobility fleet, but this is predicted to rise steeply to 80% by 2040.

If EVs proliferate in the shared mobility services to the extent predicted, the potential exposure of millions of users could indirectly help to increase adoption of privately-owned electric vehicles.

Hurdles to market penetration

For EVs to successfully penetrate the car sharing market, there will likely be a requirement for larger batteries and a more extensive network of fast chargers. Alternatively, car sharing companies may look to utilize hubs, where cars are left in designated parking spots with their own charging infrastructure, allowing for slower and cheaper scheduled overnight charging.

For taxis and ride hailing fleets, manufacturers will have to consider providing greater seat capacity and trunk space in order to effectively meet the operational requirements of these services. Charging infrastructure will again be a limiting factor until there are sufficient fast chargers to save drivers from the potential loss of revenue associated with long charging times and searching for available public charging stations.

The upfront cost of EVs will likely have to fall to incentivize individual owners to make the transition. Several operators are initiating programs to encourage their drivers to switch to electric. Uber offers financial assistance to London drivers for switching, while Lyft offers short-term lease options to allow drivers to test out the suitability of an EV in a risk-free manner.

The benefits of going green

The transportation sector accounts for over a quarter of total U.S. greenhouse gas (GHG) emissions. Because of this, many organizations now recognize the important role that they play in minimizing the harmful effects of climate change.

The benefits of greening a fleet extend far beyond environmental savings, which is why the concept has gained so much traction. The triple bottom line of sustainability (People, Planet, Profit) is interlinked, such that a saving that benefits the environment or society should also benefit the organization’s financial bottom line, or at least be cost neutral. This ensures that sustainable practices endure and are built into the organization’s culture.

Source: https://www.geotab.com/white-paper/electric-vehicle-trends/

Positioning (mission) statement: To launch the first electric SUV in the Bahraini market, being the top-of-mind brand in terms of innovation and connectivity.

Omar Mal,

November 3, 2020